tax abatement definition government

A sales tax holiday is another instance of tax abatement. This statement requires disclosure of tax abatement information about 1 a reporting governments own tax abatement agreements and 2 agreements that are entered into by other governments that reduce the reporting governments tax revenues.

Abatement Cost An Overview Sciencedirect Topics

If there are more than two owners they can sign and submit additional forms.

. More simply put a tax abatement is when a local government or school district agrees to give up tax revenues it is entitled to in return for a promise by an individual or entity to take a specific future action that contributes to economic development or otherwise benefits. The remaining amount of future tax revenues to be abated. Encourage companies make capital-intensive investments.

A tax abatement is a local agreement between a taxpayer and a taxing unit that exempts all or part of the increase in the value of the real property andor tangible personal property from taxation for a period not to exceed 10 years. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. The primary purpose for this new requirement is to provide more.

Governments offer various programs to lower taxes such as tax exemptions deductions rebates and abatements. A one or more governments promise to forgo tax revenues to which they are otherwise. A tax abatement credit is generally given to a firm when the government wants the saved money to be spent in another way.

Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. Such arrangements are known as tax abatements. Properties with a 10-year residential tax abatement arent eligible for the Homestead Exemption.

What is tax abatement. Refer to IRM 410113 for additional discussion on requests for abatement. All work must be completed under a true and accurate permit issued by the City of Cleveland Department of Building and Housing and the property must be located in the City of Cleveland.

Income Tax Ohio Revised Code Sections related to income tax credits 71815 new jobs 718151 job retention 71816 JEDD or JEDZ Will need to review credit programs to see if they meet the GASB 77 tax abatement definition 7. Encourage a certain type of investment. 77 tax abatements are a reduction in tax revenue that has.

Tax Abatement is available to both homeowners and developers. A reduction of taxes for a certain period or in exchange for conducting a certain task. The amount of foregone tax revenues abated in the prior two reporting periods.

A company receiving a tax abatement enters into an agreement a contract with the state. A county may administer and develop a program to make loans and grants of public money to promote state or local economic development and to stimulate encourage and develop business location and commercial. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm.

In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible. Recently the GASB published GASB Statement No. To increase savings or spending rate invest in equipment or others.

A tax abatement is a property tax incentive offered by government agencies to decrease or eliminate real estate taxes in a specified location. 77 Tax Abatement Disclosures that will require those state and local governmental entities that offer tax abatements to provide details about the program or programs in the note disclosures. For the purpose of GASB Statement No.

To cancel an abatement all of the propertys owners must sign the cancellation form. When a request for abatement also includes a request for refund claim for refund procedures apply. An amended return or written request that asks for a reduction of the assessed liability.

Tax abatements are a reduction of taxes granted by a government entity to a company for a specific period of time to encourage economic development. The number of tax abatements in effect at the end of the prior two reporting periods. A tax abatement is when your tax obligations are reduced and in some cases eliminated for a certain period of time.

Under the GASB Statement 77 tax abatements have a narrow definition. Taxpayers use Form 843 to claim a refund or abatement of certain overpaid or over-assessed taxes interest penalties and. Once an abatement is removed it cannot be put back on the property.

Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Chapter 381 of the Local Government Code allows counties to provide incentives encouraging developers to build in their jurisdictions. Typically governments will offer tax abatements for a number of reasons such as.

Each contract allows a company to receive a predetermined reduction in its tax obligations. The time remaining on tax abatement agreements. Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file.

Tax Abatement applications will not be accepted for improperly permitted improvements. Tax abatement is a reduction in tax revenues that results from an agreement between one or more governments and an individual or entity in which. Abatements can range in length from a few months to several years.

What are Tax Abatements.

What Is Tax Abatement A Guide For Business Operators

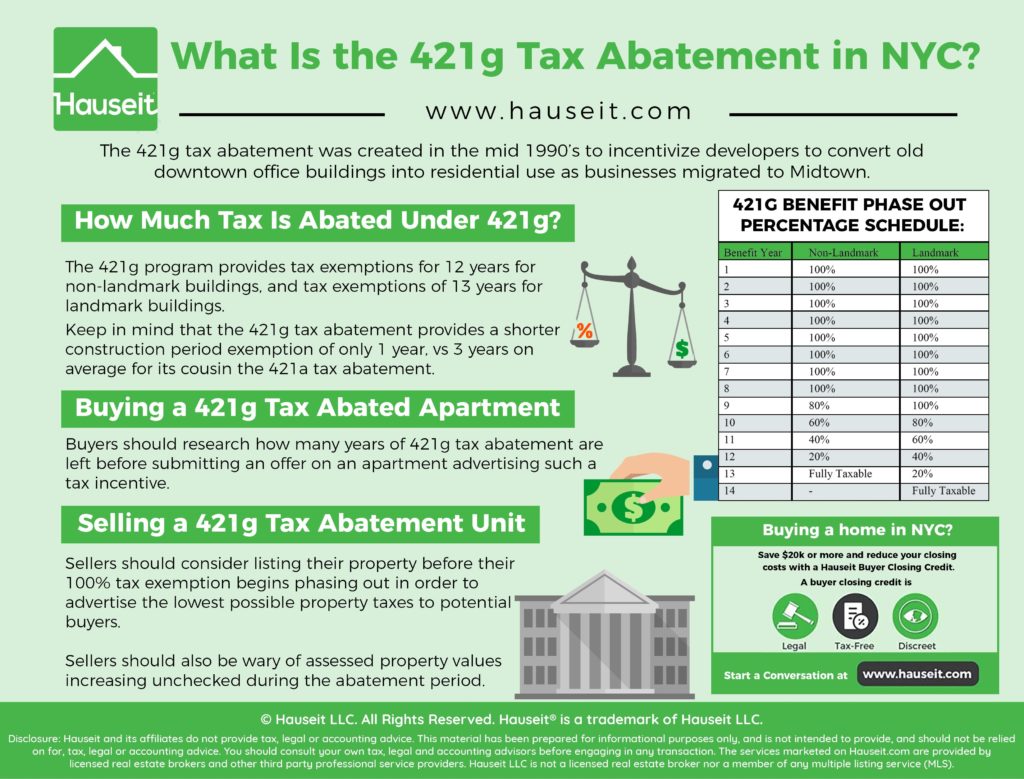

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

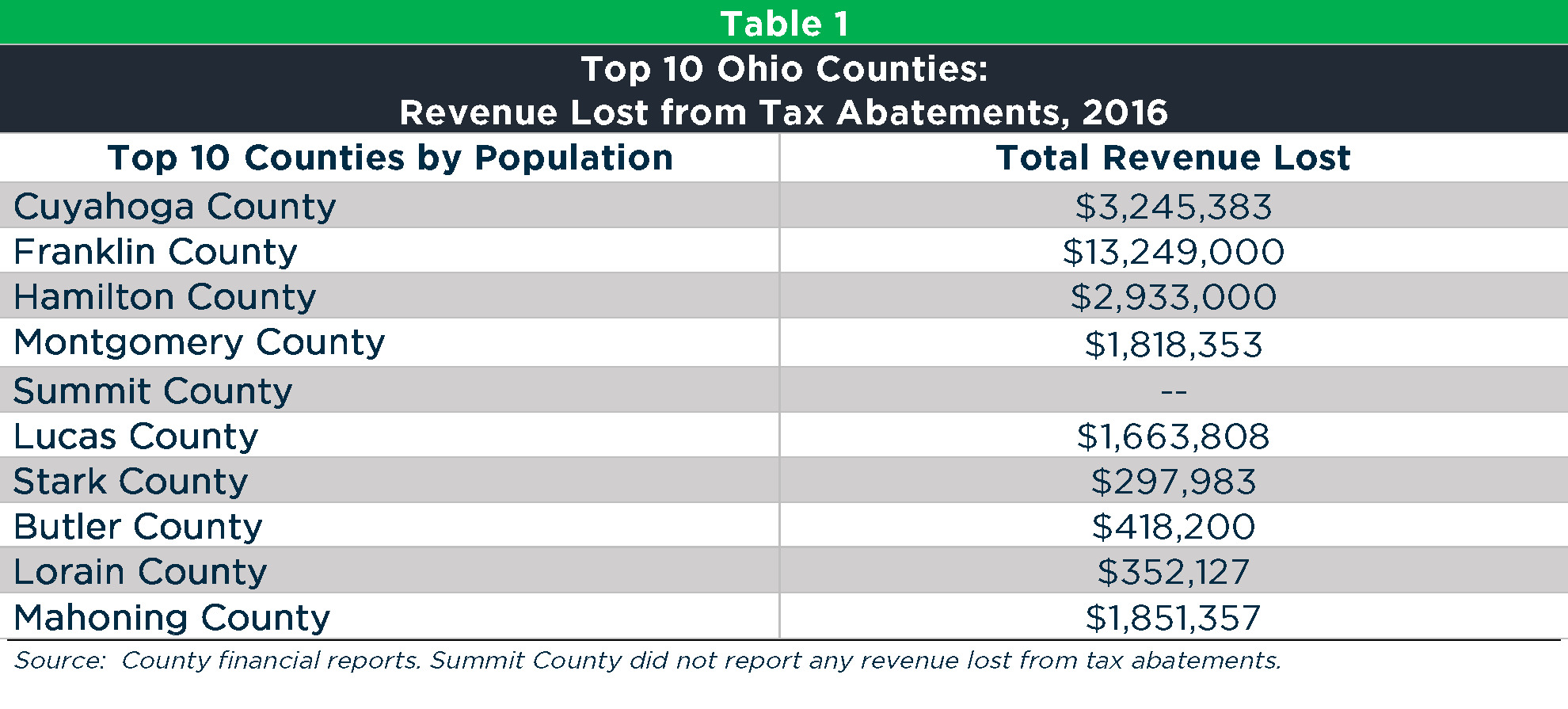

Local Tax Abatement In Ohio A Flash Of Transparency

Pigouvian Tax An Overview Sciencedirect Topics

Service Tax Legal Changes For Abatements Sap Blogs

Local Tax Abatement In Ohio A Flash Of Transparency

Abatement Cost An Overview Sciencedirect Topics

Environmental Economics Econ 101 An Emissions Tax

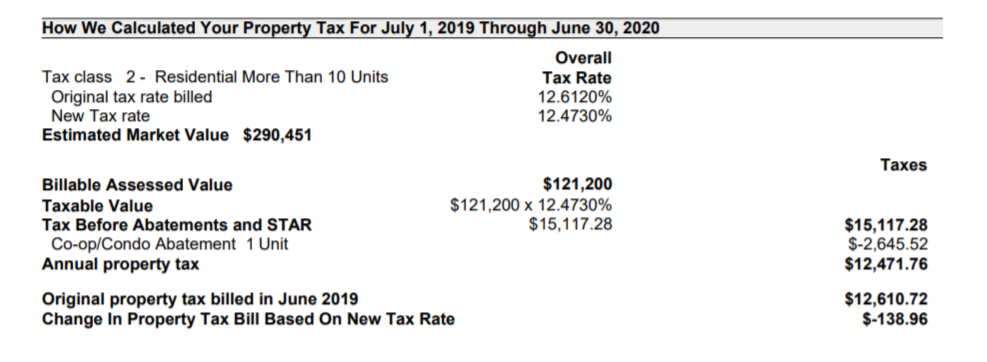

How Much Is The Coop Condo Tax Abatement In Nyc