inheritance tax on real estate nc

So if you live in N. For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212.

Wake County Nc Property Tax Calculator Smartasset

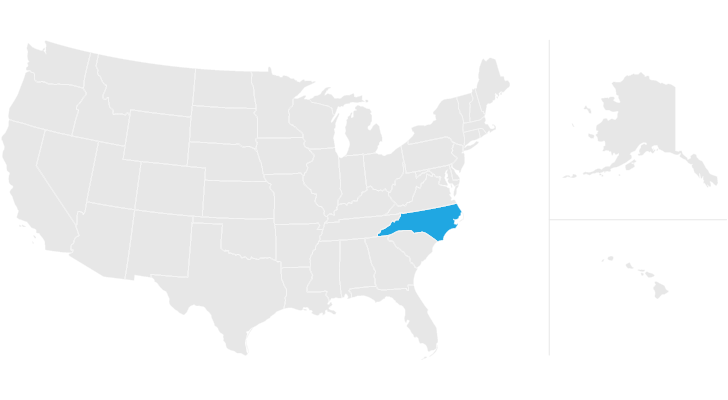

In North Carolina you are not required to pay state estate tax or inheritance tax.

. Carolina but inherit assets from an estate in another estate you could have to pay inheritance tax. The state of North Carolina does not collect inheritance tax or estate tax from estates. North Carolina residents do not need to worry about a state estate or inheritance tax.

The inheritance tax rate in North Carolina is 16 percent at the most according to Nolo. However if you inherit an estate worth over 1118 million in standard assets such as bank accounts you may be required to pay taxes federal estate tax. A loved one may also need to file a death tax return.

Estate tax of 112 percent to 16 percent on estates above 4 million hawaii. State inheritance tax rates range from 1 up to 16. Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier.

Use this form for a decedent who died before 111999. The basis of property inherited from a decedent is generally one of the following. In fact the IRS does not have an inheritance tax while some states do have one.

To determine if the sale of inherited property is taxable you must first determine your basis in the property. Unless real property is willed directly to the estate title to the land generally vests in the heirs and passes outside the administered estate. You would pay 95000 10 in inheritance taxes.

Spouses in North Carolina Inheritance Law If you have no living parents or descendants your spouse will inherit all of your intestate property. Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. Items included in the deceased persons taxable estate include real estate vehicles and the proceeds from life insurance policies explains Nolo.

However state residents should remember to take into account the federal estate tax if. The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in 2018 indexed to inflation. Surviving spouses are always exempt.

IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE. North Carolina has no inheritance tax or gift tax. The number of Indians is 18 million.

Bank accounts certificates of deposit. An estate tax certification under GS. A surviving spouse is the only person exempt from paying this tax.

For example lets say the house you just inherited from your grandmother was originally purchased in 1960 for 25000. Fortunately few states impose an inheritance tax. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax.

The estate would pay 50000 5 in estate taxes. As the recipient of an inherited property youll benefit from a step-up tax basis meaning youll inherit the home at the fair market value on the date of inheritance and youll only be taxed on any gains between the time you inherit the home and when you sell it. North Carolina does not collect an inheritance tax or an estate tax.

Estate tax or inheritance tax. Estate inheritance tax nc. North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property from someone who lived there inheritance tax.

You would receive 950000. Even though estate taxes are the subject of much debate and many people dont like the idea of the estate tax estate taxes affected less than 14 of 1 018 if you are keeping score of all decedents in 2015. Put another way that means that you have a 998 chance of never having to worry about estate taxes.

Bank accounts certificates of deposit and investment. If you die with parents but no descendants your spouse will inherit half of intestate real estate and the first 100000 of personal property. Bank accounts certificates of deposit.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. The fair market value FMV of the property on the date of the decedents death whether or not the executor of the estate files an estate tax return Form 706 United. 28A-21-2a1 is not required for a decedent who died on or after 112013.

Accordingly rents from those properties are not income to the estate and estate funds may not be used to pay real estate expenses such as mortgages taxes insurance or utilities. Regardless state residents should carefully consider how much their estates or inheritances will involve in estate taxes if they have more than 11 to claim on. Ive got more good news for you.

Mid Century Modern Homes For Sale Real Estate Mid Century Modern Home For Sale Indianapolis Mid Century Modern House Modern Homes For Sale Modern House

Home Upgrades That Really Do Add Value Night Helper Real Estate Buying We Buy Houses Selling Real Estate

North Carolina Real Estate Transfer Taxes An In Depth Guide

Matthews Reid House Photos Living In North Carolina Southern Life Local Attractions

207 N Locust St Black Mountain Nc 28711 Colorado Homes House Black Mountain

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

Explaining The Basis Of Inherited Real Estate What It Means For Your Kids

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

Why Hosts Are Leaving Vrbo And Homeaway Rental Property Buying A Rental Property Vacation Home Rentals

If You Need To Qualify For A Mortgage This Is Good News Chicago Real Estate Underwriting Mortgage

Wholesale Opportunity In Reidsville Nc We Buy Houses Flipping Houses Home Buying

North Carolina Property Taxes Compared To The Rest Of The Country

Tax Listings Personal Property Dare County Nc

North Carolina Estate Tax Everything You Need To Know Smartasset

How To Settle Sibling Disagreements And Make Better Decisions On Selling An Inherited Home Check This Out Inheritinghometips Sale House Home Selling House